G7 back new 'side-by-side' tax proposal exempting American, UK firms from global tax rules

ANI

29 Jun 2025, 10:05 GMT+10

New Delhi [India], June 29 (ANI): US-parented companies will be exempted from certain elements of an existing global tax agreement according to a statement released by the Group of Seven countires which detailed the new proposal signed by the United States and its G7 partners.

The agreement will see US companies benefit from a 'side-by-side' solution under which they will only be taxed at home, on both domestic and foreign profits, the G-7 said, in a statement released by Canada, which holds the group's rotating presidency.

Earlier this year the US Secretary of the Treasury outlined the United States' concerns regarding the Pillar 2 rules agreed by the OECD/G20 Inclusive Framework on BEPS and set out a proposed 'side-by-side' solution under which US parented groups would be exempt from the Income Inclusion Rule (IIR) and Undertaxed Profits Rule (UTPR) in recognition of the existing US minimum tax rules to which they are subject.

The side-by-side system could 'provide greater stability and certainty in the international tax system moving forward, including a constructive dialogue on the taxation of the digital economy and on preserving the tax sovereignty of all countries, the statement read.

The US Treasury Department noted that with Section 899 removed from the Senate version of the bill, there is now a shared understanding that the side-by-side system could help maintain progress made by jurisdictions within the Inclusive Framework in combating base erosion and profit shifting.

'Following the removal of section 899 from the Senate version of the One, Big, Beautiful Bill, and consideration of the success of Qualified Domestic Minimum Top-up Tax implementation and its impact - there is a shared understanding that a side-by-side system could preserve important gains made by jurisdictions inside the Inclusive Framework in tackling base erosion and profit shifting and provide greater stability and certainty in the international tax system moving forward, the G7 announced. We look forward to discussing and developing this understanding within the Inclusive Framework,' the Treasury said in a post on X.

The removal of Section 899 has also been welcomed by the United Kingdom.

British businesses, which had recently voiced concerns about potentially facing higher taxes due to the measure, will no longer be subject to those risks.

G7 officials echoed the importance of collaboration, expressing their commitment to pursuing a solution that is 'acceptable and implementable to all.'

Earlier this year, through an executive order, Donald Trump declared that the 2021 global corporate minimum tax agreement--negotiated by the Biden administration and supported by nearly 140 countries--would not apply in the United States.

He also threatened to impose a retaliatory tax on nations implementing the global tax rules against US firms, a move viewed as harmful to many foreign companies operating within the US. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Illinois Intelligencer news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Illinois Intelligencer.

More InformationNorth America

SectionAlliance eyes major military buildup to counter Russia

THE HAGUE, Netherlands: NATO is pressing ahead with a sweeping new defense spending target, calling on all 32 member nations to commit...

Economic Watch: U.S. ramps up trade pressure on multiple fronts as 90-day tariff deadline approaches

The United States is scrambling to wind up trade talks with a large number of trading partners as the self-imposed deadline of July...

Netanyahu confirms US visit next week to meet Trump, top officials

Tel Aviv [Israel], July 1 (ANI): Prime Minister Benjamin Netanyahu on Tuesday confirmed that he would travel to the United States next...

"Elon may get more subsidy than any human being in history": Trump hits out at Musk, EV mandates

Washington [US], July 1 (ANI): US President Donald Trump on Tuesday (local time) reiterated his opposition to electric vehicle (EV)...

Syria could drop demand that Israel return the Golan Heights media

Earlier, the IDF attacked the country, claiming to be protecting the Druze population Former warlord Ahmad al-Sharaa, who seized...

How Trump plays with new media says a lot about him - as it did with FDR, Kennedy and Obama

There is a strange and worrying parallel between the breakneck speed at which Donald Trump has operated in the first few months of...

International

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

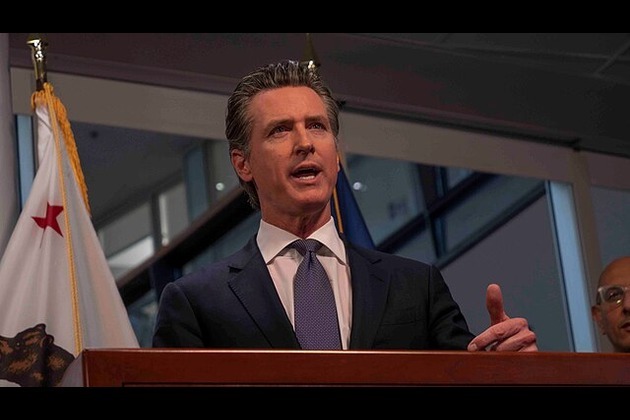

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...